Individual Retirement Account

Secure Your Future With An Individual Retirement Account*

Our Individual Retirement Account (IRA) is a great way to ensure that you will have a comfortable retirement. Not only will it benefit you after you retire, but it could be an immediate tax deduction on your federal income taxes. The interest you earn on this account could also be tax deferred until a distribution is started. It’s a great way to prepare for your future. Come by or call today.

Is an IRA Right For You?

Take our Macon Bank & Trust Company One-Minute IRA Test and find out. Then call one of our customer service representatives today at 615-666-2121.

You might also be able to save on your present taxes with an Individual Retirement Account, by deducting your qualified contributions from your taxable income. Many Americans can deduct all or part of their IRA contributions from current income taxes. The deductible amount depends on your income, marital status and whether you’re an active participant in an employer sponsored plan as defined by the Internal Revenue Service.

With an Individual Retirement Account, you may also be able defer taxes until you retire when you will probably be in a lower tax bracket. The chart below shows you how much you may be able save each year. You may want to consult your tax advisor to review the tax deductible status of an IRA. Regardless of the amount you’ll be able to save now on taxes, an IRA is a smart way for you to save for a secure retirement.

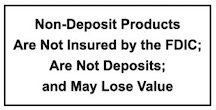

*This account is insured by the FDIC up to $250,000 (per depositor).IRA Tax Savings Potential Chart:

| IRA Deductible Contribution Amount |

15 % Tax Bracket Savings |

28 % Tax Bracket Savings |

31 % Tax Bracket Savings |

36 % Tax Bracket Savings |

39.6 % Tax Bracket Savings |

| $ 500 | $ 75 | $ 140 | $ 155 | $ 180 | $ 198 |

| $ 1,000 | $ 150 | $ 280 | $ 310 | $ 360 | $ 396 |

| $ 2,000 | $ 300 | $ 560 | $ 620 | $ 720 | $ 792 |

| $ 2,250 | $ 337 | $ 630 | $ 697 | $ 810 | $ 891 |

| $ 4,000 | $ 600 | $ 1,120 | $ 1,240 | $ 1,440 | $ 1,584 |

If You’re Changing Employers, An IRA Rollover Makes Sense. If you are retiring or changing jobs and anticipate withdrawing money from your employer’s retirement plan, let us help you find and IRA plan that’s right for you. We’ll explain the process and how to avoid any withdrawal penalties. Of course, you should also consult your tax professional. Give one of our customer service representatives a call at 615-666-2121 for more information.